Are you looking to endorse a check over to someone else? Keep reading as we've compiled the steps you need to take to easily sign a check to someone else.

While digital players are becoming increasingly popular in the financial ecosystem, checks are still a popular banking method for most people.

In fact, a survey run by Yahoo Finance confirms that 55% of Americans still wrote checks in 2022.

From the survey, we can confirm that most employers out there still use checks for issuing payments to their employees and that a good number of individuals choose to get paid through checks.

Whether you're into digital banking options or not, there should probably be a time when you've found that using a check is convenient.

However, if the need to sign a check carrying your name over to someone else arrives, probably because you're looking to pay them through a third-party check, or because you can't deposit the check into your account, you might wonder how to endorse a check to someone else.

Thankfully, you've come to the right place.

In this article, we've covered the steps required to sign a check over to someone else and a few other things to know when cashing a third-party check.

Table of Contents

Can You Sign A Check Over To Someone Else?

Yes, you can sign or endorse a check over to someone else.

However, there are some conditions to be met to sign a check over to someone else, including endorsing the back of the check and making sure the third-party bank will allow them to cash the third-party check.

How To Endorse A Check To Someone Else

Endorsing a check to someone else is very simple and straightforward.

However, as earlier mentioned, you need to make sure some conditions are met, which include:

- Endorsing the back of the check.

- Ensure the third-party bank accepts endorsed checks.

The best way to ensure that the bank accepts third-party checks is to go through the bank's policy or Terms and Conditions pages. These pages usually include information regarding most (if not all) of the bank's financial services.

For your convenience, we'll later share with you some banks that cash third-party checks.

Going back to endorsing a check to someone, there are some steps to follow to make this possible and legitimate.

1. Prepare And Get Things Ready

Planning and preparing properly to endorse a check to someone else is crucial, since in most cases, the process might be tricky.

Preparing goes with making sure the person or entity (third party) you're endorsing the check to accepts a signed-over check. This is important, especially for those looking to make payments with checks written to them.

Tip!

To make things even more simple and legal, you can take the person you're looking to endorse the check to a bank or credit union and endorse the check in the presence of a bank teller.

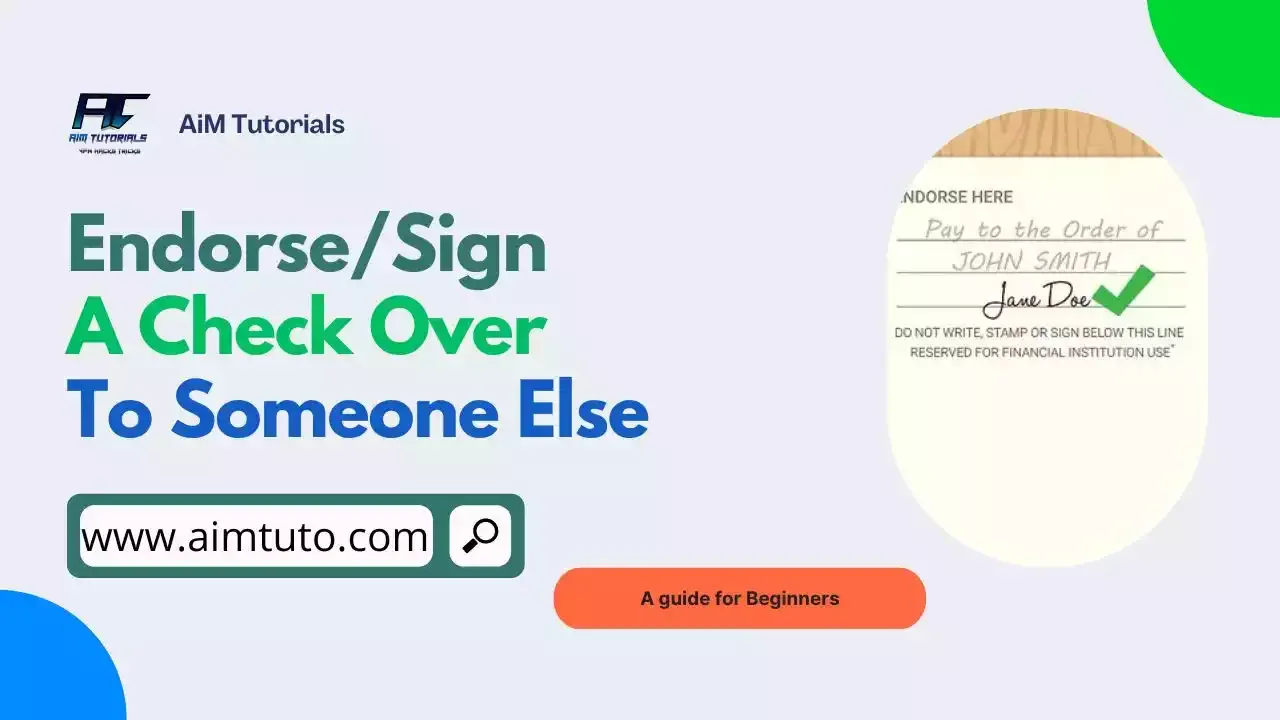

2. Sign In The Correct Area To Endorse The Check

Most financial institutions nowadays have made it even easier to endorse checks to someone else. They've included an endorsement area on the back of checks to allow those looking to sign over their checks to someone else to easily do so.

You'll usually find an area on the back of checks labeled "ENDORSE HERE" with either a space or a few lines following it, where you can write the endorsement information.

All you need to do is write "Pay to the order of [third-party's first and last name]" followed by your name signature underneath.

3. Make Sure The Names Match

When endorsing a check over to someone else, you need to make sure that the name signed on the back of the check matches the payee's name on the front of the check — that is, the original person to whom the check was written.

You need to make sure that the third party's name on the endorsement area of the check matches the name on the person's government-issued ID card.

4. Include Cashing Restrictions To The Check

Including a cashing restriction to the check helps secure you the original payee of the check. This also helps designate the check to be cashed in an ideal way.

You can even make a check restrictive for deposits to a particular account.

To do so, write "For deposit only to account #####" in the endorsement area — where ##### is the third-party's account number. This will help secure your account if in case should the check gets stolen or lost.

The endorsement in this case is called a restrictive endorsement.

5. Hand Over The Endorsed Check To The Third-Party

After endorsing and signing the endorsement area of the check, you can now hand it over to the third party to whom you've signed the check.

From there, they should be able to cash the check at a bank or credit union that accepts third-party checks.

Can Someone Cash A Check For Someone Else?

Yes, someone can cash a check for someone else. However, this will depend on a couple of factors, including whether the bank or credit union allows people to cash third-party checks.

Some banks and credit unions might only allow their customers (those holding an account with them) to cash a check for someone else and deposit it to their own bank accounts.

What Banks And Credit Unions Accept Third-Party Checks?

Most banks have made check cashing a convenient option for many. They've even made it super-easy to cash third-party checks — it just depends on the bank's policies.

While most banks won't let you cash third-party checks, a couple of others would let you cash checks that have been endorsed to someone else. However, they have some conditions which must be met.

The table below compiles some banks and credit unions that accept third-party checks, including fees for non-account holders.

| Establishment | Bank or Credit Union | Fees (non-account holders) |

|---|---|---|

| Bank of America | Bank | $8 for checks over $50 |

| Chase Bank | Bank | $8 for checks over $50 |

| Citibank | Bank | Free for checks drawn on Citibank |

| Connexus Credit Union | Credit Union | Not available |

| First National Bank | Bank | $5 |

| HSBC | Bank | None for checks drawn on HSBC; varies otherwise |

| M&T Bank | Bank | 2% of the check amount ($3 minimum) |

| Navy Federal Credit Union | Credit Union | None |

| PNC Bank | Bank | $2 for checks over $25 |

| TD Bank | Bank | $10 |

| Truist Bank | Bank | $7 for checks over $50 |

| U.S. Bank | Bank | Not available |

| Source - firstquarterfinance.com |

Can I Deposit A Check With A Different Name?

Yes, you can deposit a check to your account with a different name. However, this would only be possible if the check has been endorsed over to you on its back.

Can Someone Else Deposit A Check For Me?

Yes, someone can deposit a check for you.

You'll need to make a deposit slip with your name, account number, deposit amount, and date of deposit and write "Pay to the order of [the person's name]" so they can deposit the check for you.

Can I Deposit A Check For Someone Else?

Yes, just as someone else can deposit a check for you, you can deposit a check for someone else.

If a friend or relative can't make a mobile check deposit, the best way to cash their check is to have you deposit it for them.

The same conditions are, however, to be met, which include the person making a deposit slip with their name, account number, deposit amount, and date of deposit and endorsing the back of the check.

Once these conditions are met, you can take the check to a bank or credit union that cash third-party checks and have the check deposited.

Can I Mobile Deposit Someone Else's Check?

Yes, you can mobile deposit someone else's check.

A couple of banks and credit unions, as earlier mentioned, will let you mobile deposit someone else's (third-party) check to your bank account.

Again, this will depend on the bank's policies.

What Happens If Your Deposit Someone Else's Check?

Depositing someone else's check into your bank account can result in some consequences especially when not done legally — that is if you weren't authorized to deposit the check.

Some possible consequences include:

- The bank may refuse to accept the deposit.

- The bank may place a hold on the funds.

- The bank may freeze your account.

- The original check owner may dispute the transaction.

- You may face a legal process.

Following all this, I'll strongly recommend depositing someone else's check into your account only when you've been legally authorized to do so — that is, the check has been legally endorsed or signed over to you.

I Found A Check Can I Cash It?

No, you can't cash a check that you just found. I mean, that's not even legally possible.

Unless the check has been endorsed or signed over to you, you can't cash a check you just found since banks will require its endorsement before you they let you cash it.

Frequently Asked Questions

Can I deposit someone else's check in my account if they endorse it?

Yes, if the endorsement was legally done, then you can deposit the check into your account. However, you'll need to make sure that the bank accepts third-party checks.

How can I cash a check Not in my name?

The best way to cash a check not in your name is to have the check endorsed to your name. This way, you'll be legally authorized to cash the check, and the check in this case will become a third-party check.

How do I endorse a check for a mobile deposit?

You can make mobile deposits in a snap with your iPhone or Android device through your banking app. Due to a new banking regulation, all checks deposited via a mobile service must include: 'For Mobile Deposit Only' handwritten below your signature in the endorsement area on the back of the check, or the deposit may be rejected.

Final Thoughts

Checks are still a popular banking option nowadays.

They can only be cashed by the payee, and if you're looking to pay someone through a check that has been written to your name, endorsing it to someone else is the best way to do so.

While signing a check over to someone else, make sure the name on the third party's ID matches the name on the endorsement area of the check. To make things even more legal, I'll recommend endorsing a check to someone else in the presence of a bank teller.

References:

https://www.huntington.com/learn/checking-basics/how-to-sign-a-check-over-to-someone

https://finance.yahoo.com/news/legally-deposit-check-someone-else-140026138.html

https://www.thebalancemoney.com/how-to-endorse-checks-315300